Companies are facing immense pressure to improve transparency and performance on their environment, social, and governance (ESG) goals. The stakes are high, with increased scrutiny on companies’ commitments and their results. Further, governments are enacting new ESG reporting regulations, such as the EU’s Corporate Sustainability Reporting Directive (CSRD).

With this heightened attention comes opportunities for companies not just to do right for the planet and society, but also to differentiate themselves in the marketplace. By using AI, businesses can move beyond cumbersome ESG reporting compliance to shape and extract business value from ESG initiatives. AI does this by tackling three key challenges facing corporate sustainability teams today: turning ESG goals into actionable plans, unifying fragmented ESG data, and responding to the shifting concerns of stakeholders, including investors, regulators, nongovernmental organizations, customers, and peers.

For large public companies, ESG reporting is imperative to their businesses. Yet too many businesses still consider the ESG function to be one of risk management. Examples of how ESG performance can drive competitive differentiation are broad and varied:

- Companies with strong ESG scores benefit from a lower cost of capital.

- Customers pay a premium for low-carbon or otherwise ESG-friendly products.

- Companies with clear ESG commitments have superior employee retention.

- Data-sharing with suppliers for ESG disclosure may result in more efficient and resilient supply chain networks.

Translating ESG goals into action plans

While more than 60% of the Fortune Global 500 have set formal targets for greenhouse gas emissions reductions, most struggle to turn these ambitious commitments into concrete plans. Today, many companies are significantly off-track to achieve those targets.

Investors and other stakeholders increasingly expect a level of transparency and rigor around plans to achieve corporate ESG targets not unlike what they expect for financial targets. The emerging threat of shareholder lawsuits over climate risk management, in particular, is creating urgency for corporate directors to present defensible, actionable plans. And yet, most companies lack the capabilities required to generate and monitor these plans, including automated emissions calculations, business-as-usual forecasts, and an identified set of mitigation levers that can be assembled and prioritized per financial, timeline, and risk constraints.

For long-term targets, like achieving net zero by 2050, companies struggle to assess the impact of risks and to plan for different scenarios. Corporate boards understand that decarbonization pathways will be highly sensitive to changes in internal and external factors, such as regulations, energy prices, business growth rates, and consumer tastes, but they often lack the data infrastructure and analytic capability to model and test different scenarios.

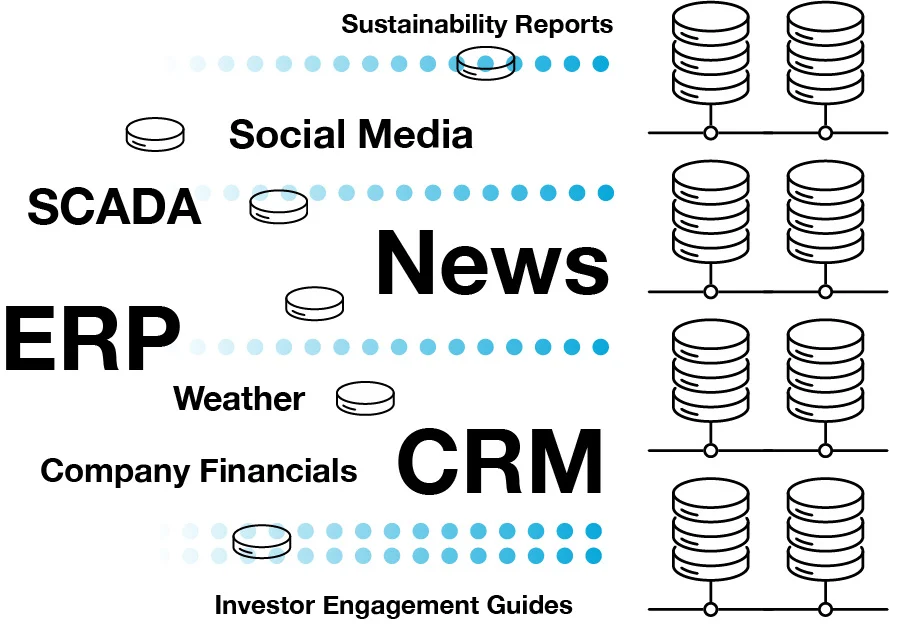

Managing disparate ESG data

The lack of a robust, unified ESG data infrastructure also tends to frustrate sustainability teams trying to meet ESG reporting requirements and inform day-to- day decisions. ESG covers a vast array of environmental, social, and governance topics, and disclosure requirements span a fragmented landscape of software systems, such as environmental health and safety, human resources, and enterprise resource planning (ERP). Furthermore, multiple overlapping ESG reporting standards and frameworks make it difficult for companies to determine what data to collect and how to best present it. Companies that embrace technologies to streamline existing data management and reporting tasks will reduce costs and free up resources for higher-value activities.

In addition to external reporting, ESG data is critical to supporting internal business decisions related to operations, supply chain, human resources, and most other business functions. You can’t manage what you don’t measure, so a unified, standardized ESG data platform is essential to a company’s ability to run an effective ESG program.

Setting priorities in alignment with stakeholders

Facing a wide variety of ESG issues and often limited internal resources, corporate sustainability teams find it challenging to keep track of the evolving concerns of internal and external stakeholders. Unable to tackle every ESG issue, companies need to prioritize the areas most relevant and important—and to align these priorities with key stakeholders.

The standard materiality assessment exercise—which attempts to address this prioritization challenge—is a labor-intensive process that is inherently limited in scope and impact. ESG expectations and requirements are constantly evolving, requiring a system that can function in near real time. Performing analysis every two years, for example, won’t suffice when an enterprise needs to capture timely insights to manage ESG risks and capture opportunities.

AI as a solution and enabler

Companies across industries today are using enterprise AI to address the most pressing ESG challenges: translating commitments into plans, establishing unified data visibility for reporting and decision-making, and proactively engaging key stakeholders to manage risks and capture valuable opportunities.

Predictive analytics now let sustainability professionals accurately estimate greenhouse gas emissions from operations (Scopes 1 & 2) and the value chain (Scope 3); they also let sustainability teams forecast emissions trajectories. Machine-learning algorithms use large volumes of both internal and external data to generate thousands or even millions of scenarios to help executives and directors strategize decarbonization pathways. Furthermore, AI can be used to optimize plans with specific schedules of emissions mitigation projects to achieve interim targets while respecting budget, resourcing, and risk constraints.

AI for data fusion and reporting automation

While many companies still use labor-intensive and error-prone Excel sheets to manage ESG data, AI solutions can now automatically unify, validate, and organize these data in near real time. The benefits to organizations using AI to power their ESG data foundations are significant. AI and machine learning can simplify existing data-wrangling and standards-mapping processes as well as future-proof against the new standards and frameworks that emerge over time.

Similarly, AI can automate data validation and alert teams to emerging risks— if, for example, a company’s performance is falling behind. Now, generative AI technologies for the enterprise will even assist sustainability professionals in writing first drafts of reports and accelerating time to insight. Perhaps most exciting for teams inundated with specific data disclosure requests, AI can automate the end-to-end process of interpreting a request, mapping it to existing key performance indicators, and producing appropriate output.

AI for responsiveness to stakeholder priorities

Advances in natural language processing (NLP) and large language models (LLMs) can replace the existing manual materiality assessment process and provide continuous insights. AI allows teams to reorient these occasional, limited-scope, backwards-looking studies into near real-time solutions that greatly expand what teams can get out of a growing amount of information—potentially analyzing up-to-date publications from every nonprofit, customer, investor, and competitor. Such a generative AI system can provide continuous and actionable feedback to mitigate potential ESG risks, improve stakeholder engagement, and capture new opportunities.

What’s Next?

As corporate demands accelerate around providing detailed, defensible plans, data transparency, and responsiveness to shifting stakeholder priorities, executives are reckoning with the question: What is the purpose and value of ESG for my organization?

For businesses that choose to treat ESG performance as a source of competitive advantage, the opportunity for value creation and improved resilience is enormous. AI digital solutions for forecasting and planning, data fusion and reporting, and real-time stakeholder risk and opportunity analysis will continue to be a critical enabler of their success.