- AI Software

- C3 AI Applications

- C3 AI Applications Overview

- C3 AI Anti-Money Laundering

- C3 AI Cash Management

- C3 AI Contested Logistics

- C3 AI CRM

- C3 AI Decision Advantage

- C3 AI Demand Forecasting

- C3 AI Energy Management

- C3 AI ESG

- C3 AI Health

- C3 AI Intelligence Analysis

- C3 AI Inventory Optimization

- C3 AI Process Optimization

- C3 AI Production Schedule Optimization

- C3 AI Property Appraisal

- C3 AI Readiness

- C3 AI Reliability

- C3 AI Smart Lending

- C3 AI Sourcing Optimization

- C3 AI Supply Network Risk

- C3 AI Turnaround Optimization

- C3 Generative AI Constituent Services

- C3 Law Enforcement

- C3 Agentic AI Platform

- C3 Generative AI

- Get Started with a C3 AI Pilot

- Industries

- Customers

- Events

- Resources

- Generative AI for Business

- Generative AI for Business

- C3 Generative AI: How Is It Unique?

- Reimagining the Enterprise with AI

- What To Consider When Using Generative AI

- Why Generative AI Is ‘Like the Internet Circa 1996’

- Can the Generative AI Hallucination Problem be Overcome?

- Transforming Healthcare Operations with Generative AI

- Data Avalanche to Strategic Advantage: Generative AI in Supply Chains

- Supply Chains for a Dangerous World: ‘Flexible, Resilient, Powered by AI’

- LLMs Pose Major Security Risks, Serving As ‘Attack Vectors’

- What Is Enterprise AI?

- Machine Learning

- Introduction

- What is Machine Learning?

- Tuning a Machine Learning Model

- Evaluating Model Performance

- Runtimes and Compute Requirements

- Selecting the Right AI/ML Problems

- Best Practices in Prototyping

- Best Practices in Ongoing Operations

- Building a Strong Team

- About the Author

- References

- Download eBook

- All Resources

- Publications

- Customer Viewpoints

- Blog

- Glossary

- Developer Portal

- Generative AI for Business

- News

- Company

- Contact Us

Grow Cash Portfolio by Preventing Balance Attrition

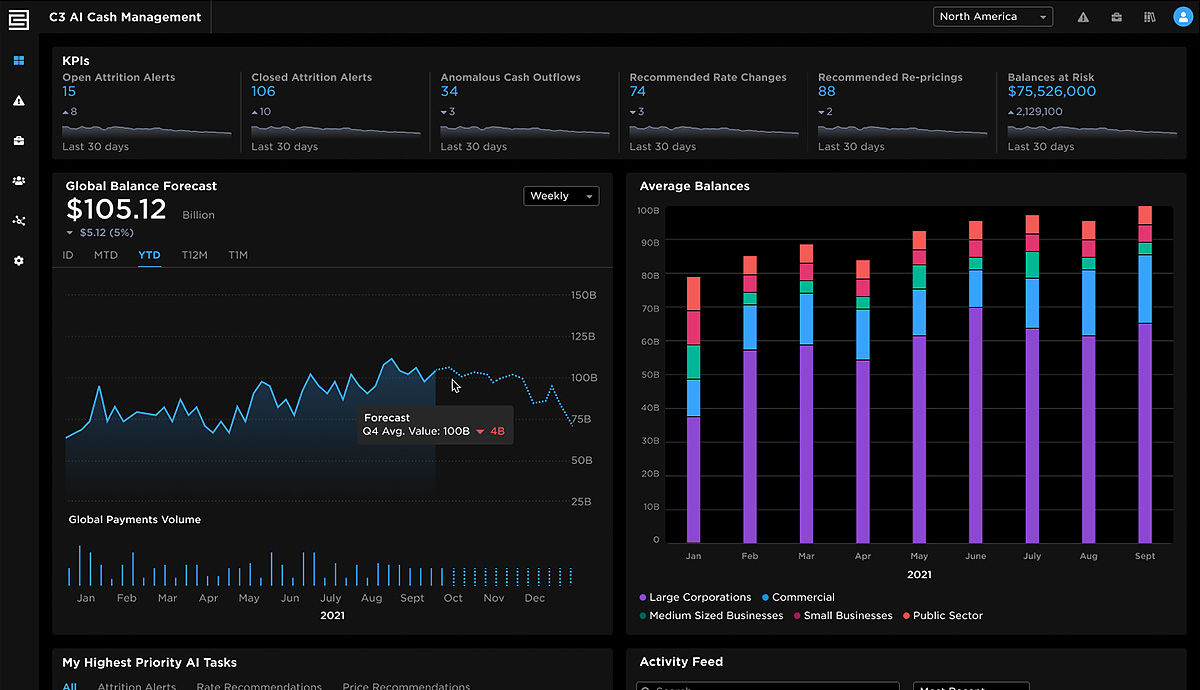

C3 AI Cash Management

C3 AI Cash Management uses sophisticated machine-learning techniques to help liquidity managers gain visibility into client cash balances and prioritize actions to both prevent balance attrition and win additional balance with optimized rate offers. The application leverages advanced AI algorithms to quantify client rate sensitivity and predict the clients most likely to reduce or end their relationship with the financial institution. These rate sensitivity insights enable liquidity and relationship managers to take targeted action in near real-time.

Demonstrated Benefits

60%

Balance attrition predicted with up to 90 days advance warning

$10 Billion

Annual deposit balance retention opportunity

1 Billion

Transactions processed annually for AI models and exposed for end-user analysis

Transforming Cash Management with Enterprise AI

Daily balance volatility makes it difficult to differentiate normal and abnormal balance changes

AI-based, interpretable warning signals identify risky balance behavior

Each relationship manager is responsible for too many clients to monitor account activity

AI-based predictions alert relationship managers of impending balance attrition

Relationship managers make decisions based on an incomplete view of the client relationship

360-degree customer view unifies client relationship and activity data

Existing solutions provide only backward-looking analysis

AI models identify anomalous client account balance activity

Treasury teams do not have an accurate view of client rate sensitivity

AI-based rate and price sensitivity predictions enable targeted rate and pricing decisions

Existing solutions do not provide recommended actions for high risk clients

AI-based recommendations and advanced interpretability support optimal client offers

Succesful Deployments

Preventing Customer Churn for a Multinational Bank

Preventing customer churn and improving profitability for a bank's cash management business.

Learn more