By Burt Mayer, Director, Products

Expectations for corporate environmental, social, and governance (ESG) reporting have become much more comprehensive in both the scope and frequency of disclosures. Multiple overlapping reporting standards and frameworks make it difficult for companies to determine which data needs to be collected and how best to present it.

To simplify this complicated and confusing process, C3 AI developed an AI application that makes it easier to track, report, and set goals, and, in the process, also invented a new way to standardize ESG data. The application, C3 AI ESG, uses a new concept — we’ve named the ESGbit™ — to decompose and store all necessary ESG information.

Why we need the ESGbit

Businesses face two major difficulties when working to meet ESG disclosure requirements. First, the data required for ESG disclosures tends to be distributed across many disparate source systems. Second, there is no gold standard for the format and contents of ESG disclosures; most companies produce ESG reports that align to many or all of the ever-evolving, voluntary standards, even when it requires onerous and repetitive data preparation.

The impact of these challenges is that corporate sustainability teams with limited resources are forced to spend the bulk of their efforts on data aggregation and reporting challenges rather than the much higher value activity of ESG strategy and planning.

We developed both C3 AI ESG and the ESGbit to provide a direct response to those two challenges. At the most fundamental level, the ESGbit encodes different types of ESG information into standardized atomic units that futureproof workflows. This replaces the need for sustainability professionals to create separate spreadsheets for each new metric — a time-consuming, tedious and expensive process.

Defining the ESGbit

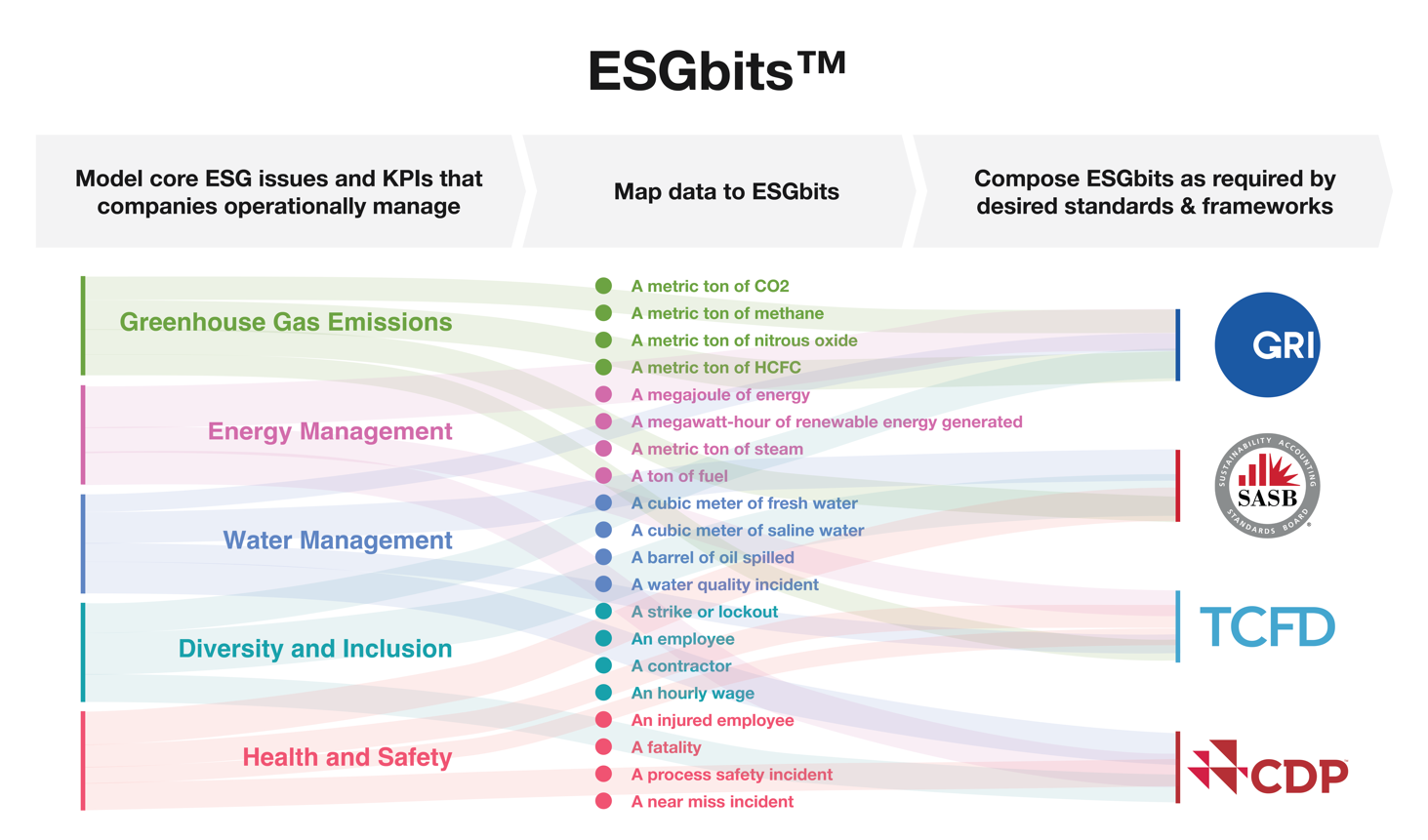

All ESG data can be expressed as ESGbits — anything from a kwh of electricity consumption at a manufacturing facility to a safety incident at a facility.

Defined as the elemental unit of measurement of ESG information, the ESGbit encodes information at the atomic level (e.g., a metric tonne of CO2, a gallon of water, a workplace injury). ESGbits may be associated with an asset, a location, a line of business, and/or the overall organizational entity.

C3 AI ESG automatically extracts relevant ESGbits from the universe of relevant enterprise information systems in use including ERP, CRM, SCADA systems, OSI PI historians, sensor networks, procurement systems, and HR systems. Stored as time-series data, the ESGbit serves as a single source of truth for all organizational ESG data providing the capability for the C3 AI ESG application to reassemble ESGbits in whatever combinations and permutations necessary to report ESG results in the multiplicity of ESG reporting standards including but not limited to SASB, GRI, TCFD, CDP, and others that will follow.

Other example ESGbits include:

- A mtCO2e scope 1 emissions from a machine or facility (e.g., paper machine, manufacturing plant)

- A MWh renewable electricity generation from a generating asset (e.g., solar panel)

- An antitrust violation in a business unit

- An instance of harassment at a facility

To calculate proportions, sums, and rates of change for ESGbits, we can use simple logic. Performance measures can be flexibly re-aggregated to quantify ESG performance along:

- any performance measure dimension (e.g., a metric ton of scope 1 CO2e emitted, a metric ton of total CO2e across scopes 1, 2, and 3)

- at any level across the organization (e.g., machine, facility, business unit, or the full organization), and

- per any standard or framework (e.g., SASB, CDP, GRI, and TCFD)

Why we call it the ESGBit

The name ESGbit comes from the information theory. During the early 20th century, electromechanical relays were becoming more widespread and used for growing technology like telephone call routing switches. Like the ESG problem, these relays needed fit-to-purpose frameworks, but all the resolutions were redundant, inefficient, and inflexible.

The solution to this problem came in the 1940s when an American mathematician named Claude Shannon defined the concept of a binary digit or “bit” based on his work a decade earlier, which determined that switching circuits could be used to implement any Boolean logic. Shannon introduced the bit as the elemental unit for the quantification of information.

The ESGbit for a better future

Today, C3 AI works with customers to forecast ESG performance, align projections to targets, assess various business scenarios, and identify specific actions to improve performance to achieve goals. And by standardizing data into an ESGbit, we undercut all the major issues businesses face with ESG reporting. It gives companies a way to flexibly report to multiple external standards and to create new internal standards to track progress against targets that are the most meaningful for that organization.

Perhaps the most important challenge facing corporate sustainability teams — the need to create specific, realistic plans to achieve ESG goals over time — is also greatly facilitated by ESGbits. Isolated and inconsistent data as well as a lack of AI and machine-learning (ML) capabilities often prevent organizations from identifying specific and viable strategies to achieve short-, medium-, and long-term goals. Sustainability teams today must spend significant time and energy wrestling with and wranging ESG data just to calculate aggregate KPIs, let alone the additional time it takes to unearth meaningful insights.

A unified, federated data image represented in elemental ESGbits enables flexible analytics and the application of AI/ML to forecast future ESG performance, align projections to targets, assess various business scenarios, and identify specific actions to improve performance to achieve goals. The use cases for AI/ML are near limitless.

To learn more about C3 AI ESG and the ESGbitTM, register now for our upcoming webinar on April 25 at 10:30AM PT.