Improving AML Investigation Efficiency

Challenge

A large, multi-national bank operates Anti-Money Laundering (AML) compliance programs to identify and report money-laundering and other suspicious activity across its 15 million global customers.

The bank faces significant challenges with the efficiency and effectiveness of its compliance programs. Bank investigators handle a growing number of false-positive alerts, which negatively affect case investigation quality and team productivity, and make it difficult to prioritize and identify true, high-risk money laundering activities.

Moreover, the data required to detect suspicious activities are segregated across several disparate systems, including Know Your Customer (KYC), transaction monitoring, external watchlist screening and several others, resulting in a highly manual investigation process.

Approach

The bank leadership tried a new approach – C3 AI® Anti-Money Laundering – to reduce false positives and increase alert quality to identify actual suspicious activity. C3 AI Anti-Money Laundering leverages advanced, proven, typology-driven risk analytics as inputs to sophisticated and interpretable machine learning algorithms.

Embedding the C3 AI Anti-Money Laundering application within its existing business processes, the bank increased team efficiency and improved prioritization of money laundering and other suspicious activity. Further, the bank can utilize the entity-centric, workflow-enabled application to improve case investigation consistency and streamline regulatory reporting.

About the Multi-National Bank

- $50 billion annual revenue

- $3 trillion assets under management

- 15 million total customers and 62,000 employees

Project Highlights

- 12 weeks from kick-off to production-ready application

- 2 years of historical data from 11 data sources

- 85% reduction in false-positive alerts

- 200% increase in number of suspicious activity cases identified

- 5,000+ time-based expressions constructed for machine learning

- Natural Language Processing (NLP) used to detect suspicious activity

C3 AI AML Benefits to Bank’s Investigators

- Reduce false-positive alerts and increase alert quality

- Apply advanced risk analytics and machine learning at-scale

- Produce easy-to-interpret results that explain key risk drivers

- Perform efficient case investigations with sophisticated visual analyses

- Leverage intelligent client segmentation on an enriched data set

- Build audit-compliant investigation packages by aggregating all relevant information supporting cases of suspicious activity

- Create and deliver regulator-ready Suspicious Activity Reports (SARs)

Results

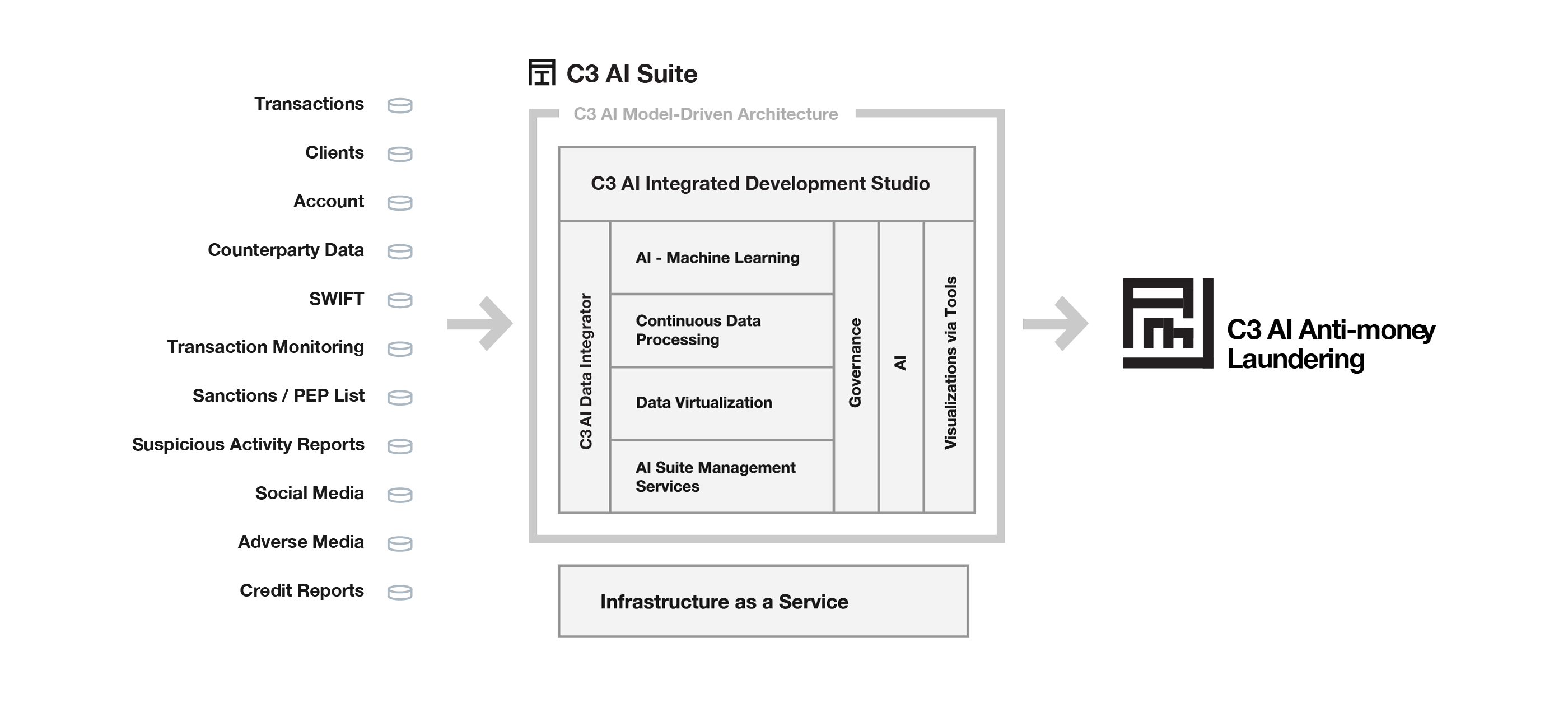

Solution Architecture