Optimizing Securities Lending Transactions

Overview

A large, multinational financial services company provides securities lending brokerage services to enable hedge funds and similar clientele to short-sell securities.

The bank’s hedge fund clients make hundreds of thousands of inquiries every day regarding available securities inventory for short selling. To compete, the bank has to rapidly respond to these inquiries despite high uncertainty regarding both hedge fund demand and securities supply. Securities lending groups have historically relied on a combination of rules-based software and manual review to address this challenge.

Unfortunately, because of the high uncertainty inherent in securities lending, existing processes routinely reject tens of thousands of highly profitable, executable opportunities, making the bank less competitive with its hedge fund clientele.

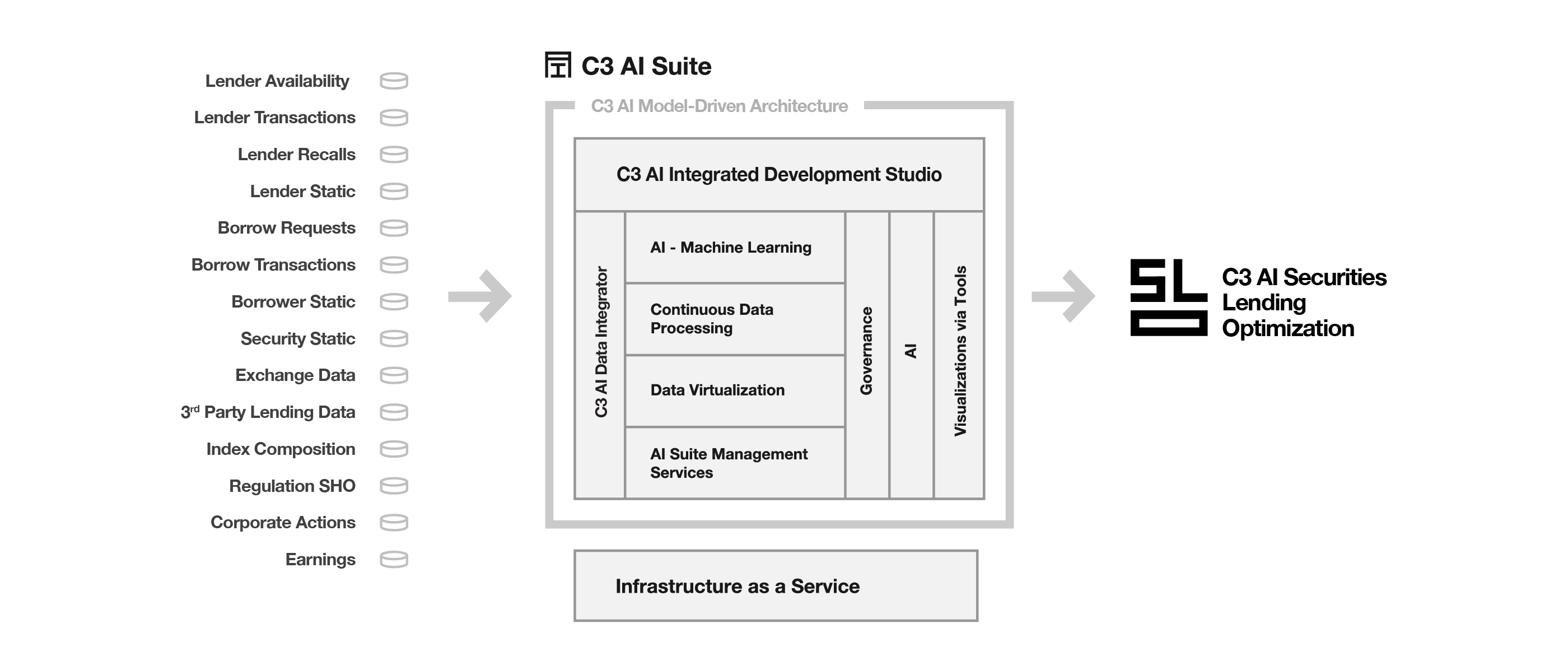

The bank tried a new approach – C3 AI® Securities Lending Optimization, a SaaS application built with the C3 AI Platform – to quantify client and lender uncertainties using machine learning. This enabled the bank to approve more client requests automatically and accurately track client obligations intraday.

About the Multi-National Bank

- $100 billion annual revenue

- $400 billion in corporate cash balances managed

- 200,000 corporate cash management clients

Project Highlights

- 16 weeks from project start to production-ready application

- 2 years of historical data from 25 data sources

- 400+ time-based machine learning features

- 100+ million predictions across 2 years

- 98% reduction in manual review

- 40% increase in profitable “hard-to-borrow” requests approved

- $25 million increase in annual revenue

Results

Solution Architecture

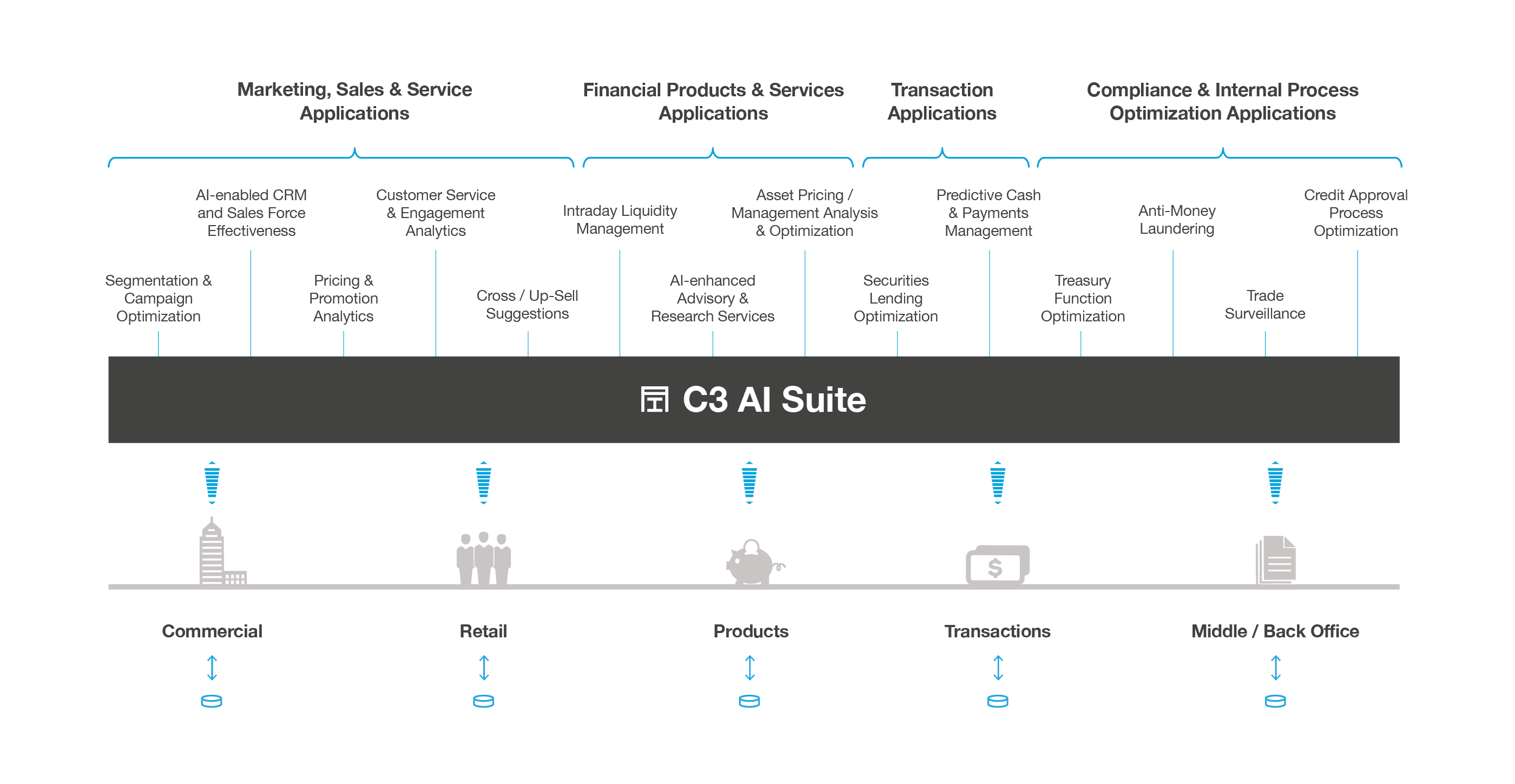

Enterprise AI for Financial Services

The C3 AI Platform provides the necessary, comprehensive capabilities to build enterprise-scale AI applications 25x faster than alternative approaches. The C3 AI Platform applies machine learning to all relevant data sources to generate predictive insights that can be used to enhance rules-based banking systems, improve critical compliance and operational processes, and transform customer experiences.

A recent study of the value chains of three major global banks demonstrated that the annual economic value of the C3 AI Platform deployed across each enterprise could exceed $100 million.