Rethinking Commercial Credit with AI

Challenge

One of the largest banks across Asia, Africa, and the Middle East, with presence in over 60 countries, manages an end-to-end commercial lending process that is responsible for providing clients with more than $100 billion worth of credit.

The bank’s commercial lending process is complex. A team of hundreds of relationship managers, analysts, and credit officers must efficiently provide many credit products and services to thousands of businesses spread across dozens of countries and sectors. To do this, the bank must quickly assess the credit worthiness of its clients, which requires collecting, reviewing, and analyzing thousands of fields of both qualitative and quantitative information including financial statement line items, performance metrics, credit history, and natural language assessments of the borrower’s business prospects. Credit officers need to navigate disparate systems, iterate with relationship managers and credit analysts on credit structure and conditions, and request additional information before making a final decision. Often, the average time-to-decision is measured in weeks.

Approach

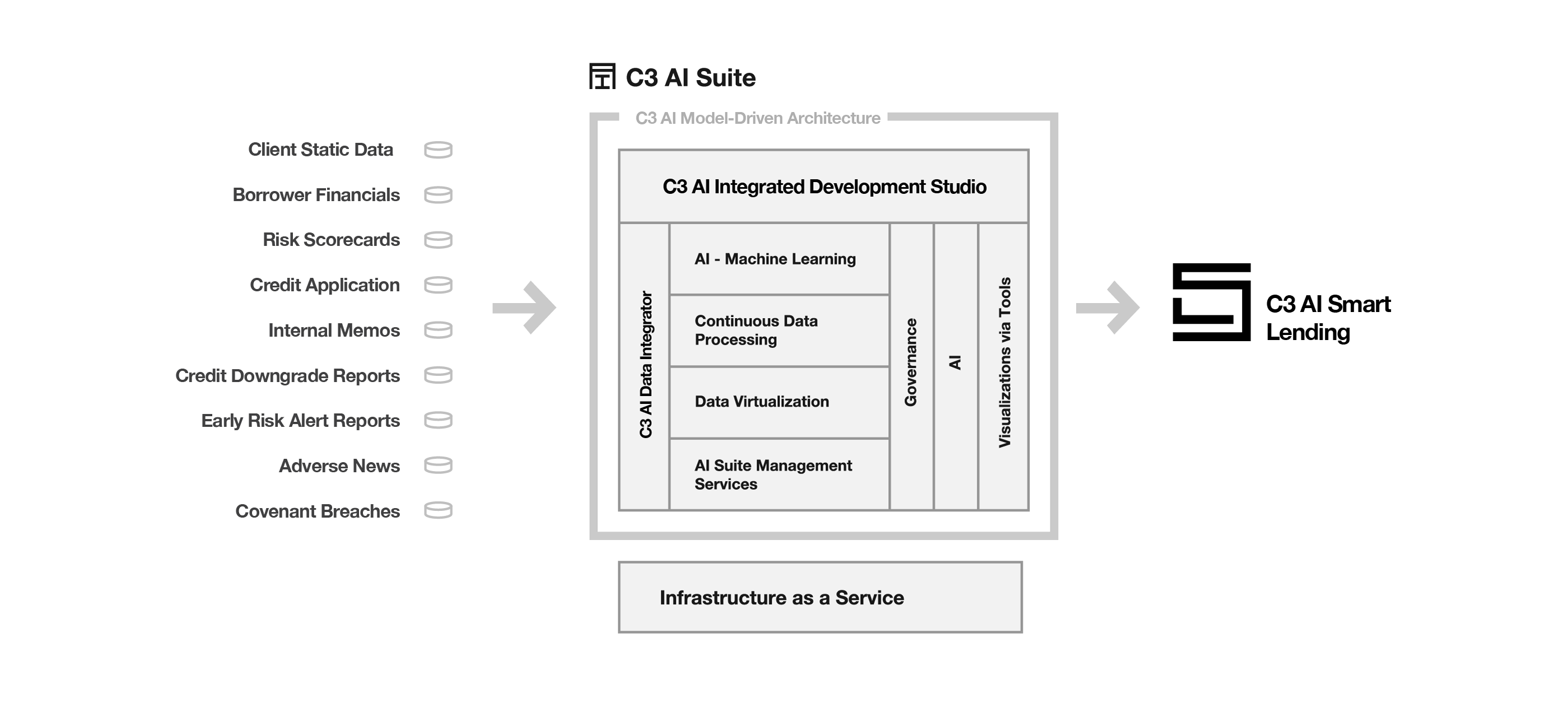

With C3 AI® Smart Lending, a SaaS application built with the C3 AI Platform, the bank can reengineer its lending process using machine learning to reduce average approval cycle time by 30%. This streamlined process enables the bank to extend more credit, accelerate revenue, and improve customer satisfaction.

About the Bank

- $14 billion annual operating income

- 68 countries of operation globally

- 85,000 employees

Project Highlights

- 12 weeks from kick-off to production-ready application

- 9 different data sources

- 68,000 applications processed, 4 years of history from 20 different countries

- 1,300+ fields per application

- 1,000+ machine learning features

- 19 categories, ~100 typologies to provide interpretable, actionable insights

- 98% precision and 81% recall for approved cases

- $100 million expected annual economic revenue benefit

- 30% reduction in average cycle time

Results

Solution Architecture

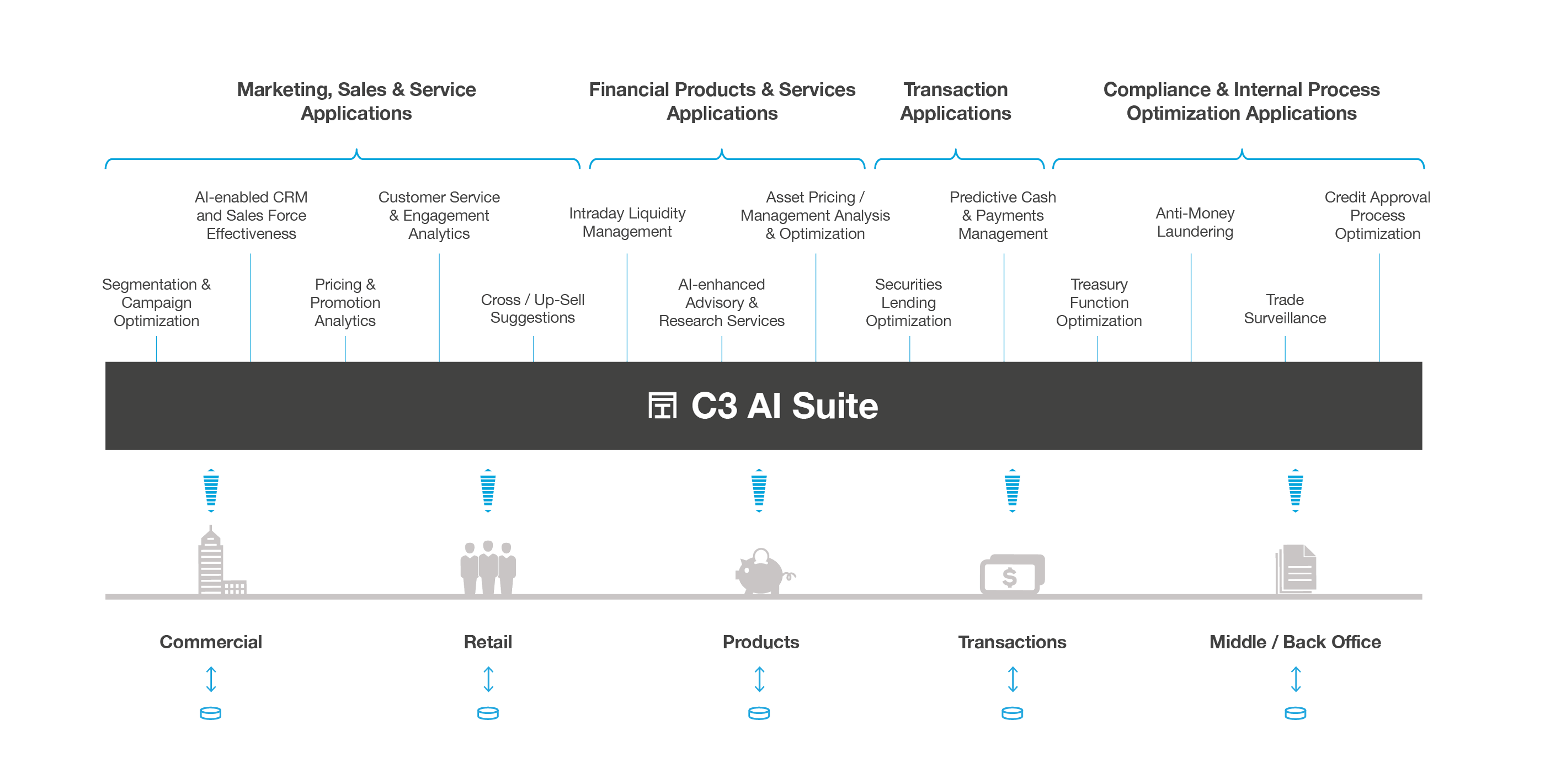

Enterprise AI for Financial Services

The C3 AI Platform provides the necessary, comprehensive capabilities to build enterprise-scale AI applications 25 times faster than alternative approaches. The C3 AI Platform applies machine learning to all relevant data sources to rapidly generate predictive insights that can be used to enhance rules-based banking systems, improve critical compliance and operational processes, and transform customer experiences.

A recent study of the value chains of three major global banks demonstrated that the annual economic value of the C3 AI Platform deployed across each enterprise could exceed $100 million.