- AI Software

- C3 AI Applications

- C3 AI Applications Overview

- C3 AI Anti-Money Laundering

- C3 AI Cash Management

- C3 AI Contested Logistics

- C3 AI CRM

- C3 AI Decision Advantage

- C3 AI Demand Forecasting

- C3 AI Energy Management

- C3 AI ESG

- C3 AI Health

- C3 AI Intelligence Analysis

- C3 AI Inventory Optimization

- C3 AI Process Optimization

- C3 AI Production Schedule Optimization

- C3 AI Property Appraisal

- C3 AI Readiness

- C3 AI Reliability

- C3 AI Smart Lending

- C3 AI Sourcing Optimization

- C3 AI Supply Network Risk

- C3 AI Turnaround Optimization

- C3 Generative AI Constituent Services

- C3 Law Enforcement

- C3 Agentic AI Platform

- C3 Generative AI

- Get Started with a C3 AI Pilot

- Industries

- Customers

- Events

- Resources

- Generative AI for Business

- Generative AI for Business

- C3 Generative AI: How Is It Unique?

- Reimagining the Enterprise with AI

- What To Consider When Using Generative AI

- Why Generative AI Is ‘Like the Internet Circa 1996’

- Can the Generative AI Hallucination Problem be Overcome?

- Transforming Healthcare Operations with Generative AI

- Data Avalanche to Strategic Advantage: Generative AI in Supply Chains

- Supply Chains for a Dangerous World: ‘Flexible, Resilient, Powered by AI’

- LLMs Pose Major Security Risks, Serving As ‘Attack Vectors’

- What Is Enterprise AI?

- Machine Learning

- Introduction

- What is Machine Learning?

- Tuning a Machine Learning Model

- Evaluating Model Performance

- Runtimes and Compute Requirements

- Selecting the Right AI/ML Problems

- Best Practices in Prototyping

- Best Practices in Ongoing Operations

- Building a Strong Team

- About the Author

- References

- Download eBook

- All Resources

- Publications

- Customer Viewpoints

- Blog

- Glossary

- Developer Portal

- Generative AI for Business

- News

- Company

- Contact Us

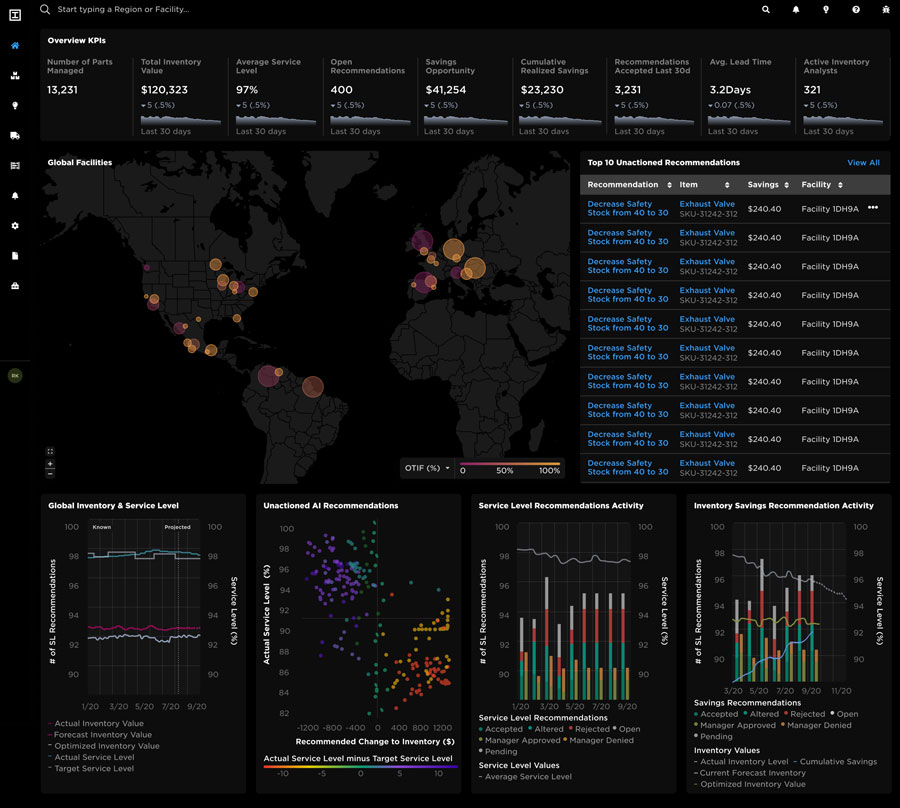

Reduce inventory, improve service levels, and maximize OTIF

Key Capabilities

Full supply chain digital twin

Full supply chain digital twin

- Gain real-time visibility across all inventory

- Create a single unified view of the supply chain integrating all ERP, MRP, and supplier data as well as external data

- Trace parts through the supply chain to uncover insights and reorganize supply chains

AI-based safety stock and reorder parameter recommendations

AI-based safety stock and reorder parameter recommendations

- Act on AI recommendations and view evidence package

- Optimize inventory of parts at each facility level

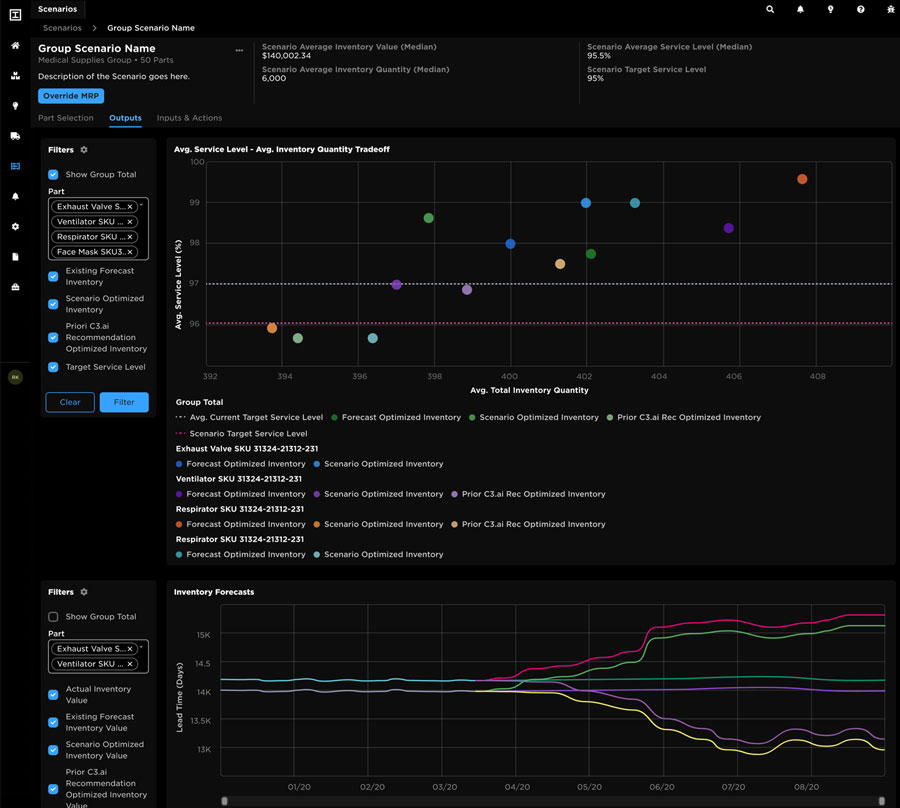

- Conduct scenario analysis before changing critical parameters

Dynamic response to supply and demand variabilities

Dynamic response to supply and demand variabilities

- Use actual data, not averages, to improve demand forecasting

- Model each supplier with its unique variabilities

- Use real-time weather and news data to highlight delay risks

BOM exploration and detailed probabilistic scenario analysis

BOM exploration and detailed probabilistic scenario analysis

- Explore and analyze current and historical BOM configurations

- Traverse BOM from finished goods to purchase parts

- Conduct comprehensive "what-if" scenario analysis

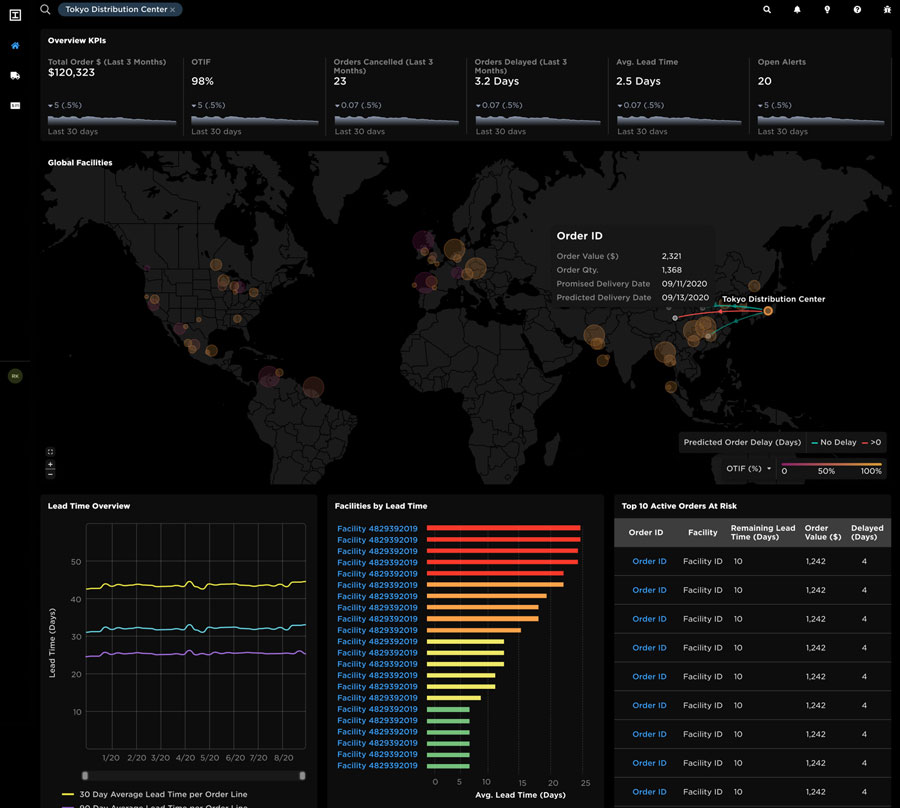

AI-based lead time predictions and configurable alerts

AI-based lead time predictions and configurable alerts

- Predict OTIF issues by identifying orders at-risk of delay

- Receive recommendations to mitigate delay risk and increase OTIF

- Configure facility-specific alerts and recommendations

Direct integration into existing ERP and MRP systems

Direct integration into existing ERP and MRP systems

- Unify data from all global ERP instances

- Use bidirectional integration with existing systems of record

- Achieve improved S&OP performance

Scope

C3 AI Inventory Optimization can be deployed across all types of inventory, a rich variety of production and fulfillment strategies.

Manufacturing Processes

Assemble to Stock

Assemble to Order

Make to Stock

Make to Order

Inventory Type

Raw materials

Work-in-progress

Finished goods

Industries

Industrial Manufacturing

Oil & Gas

Aerospace & Defense

Healthcare

Retail

Utilities

Consumer Packaged Goods

Benefits for Supply Chain Professionals

Supply Chain Executive

View all inventory in real-time across the global supply chain. Set and achieve inventory and service level targets.

Supply Chain Managers & Analysts

Improve supply chain productivity and efficiency with AI-based recommendations to optimize inventory and improve customer outcomes such as service levels and OTIF.

Inventory Buyers

Procure the right inventory at the right time in the right amounts, all from within an intuitive, workflow-enabled user stream.

Supply Chain Planners

Identify orders at-risk of delay and intervene to reroute inventory, change order prioritize, and expedite deliveries.

Data and Architecture